Your credit score is a key financial tool. It helps you get better interest rates, loan terms, and even job offers. This guide will cover everything about credit scores. We’ll show you why they’re important and how to make yours better.

Whether you want to buy a house, finance a car, or just have a strong credit profile, knowing about credit scores is crucial. It’s the first step to taking control of your finances.

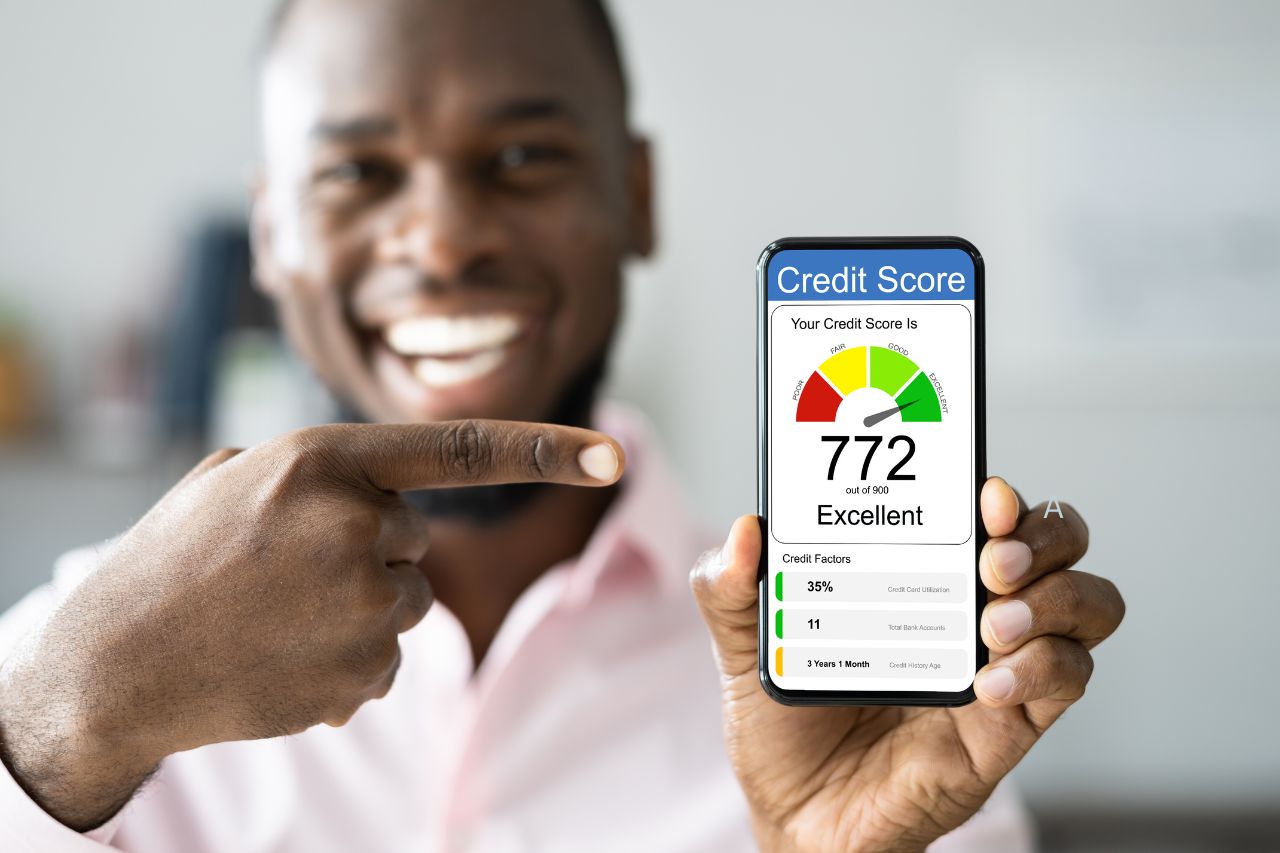

A visually engaging illustration of a credit score gauge, featuring a gradient color spectrum from red to green, representing poor to excellent scores. Surrounding the gauge, incorporate abstract representations of financial elements like coins, dollar bills, and credit cards. The background should be a soft blur of vibrant financial icons, conveying the concept of financial health and improvement.

Key Takeaways

- Credit scores are a crucial indicator of your financial health and creditworthiness.

- Maintaining a good credit score can lead to more favorable loan terms, lower interest rates, and improved financial opportunities.

- Factors like payment history, credit utilization, and credit history length contribute to the calculation of your credit score.

- Developing healthy financial habits, such as paying bills on time and keeping credit card balances low, can help you improve your credit score.

- Regularly monitoring your credit report and addressing any errors or discrepancies can also boost your creditworthiness.

What is a Credit Score and Why Does it Matter?

Your credit score shows how well you handle money, which is key to your financial health. It’s a three-digit number between 300 and 850. Lenders use it to decide if they should lend you money. Knowing about credit scores is crucial because it affects your ability to get loans, credit cards, and even rent a place.

The Importance of a Good Credit Score

A high credit score, above 700, can lead to better financial options. Lenders will likely approve your loan requests and give you lower interest rates. This can save you thousands over time. On the other hand, a low score means you might face higher rates, smaller credit limits, or even get your loan denied.

How Credit Scores are Calculated

- Payment History (35%): Your history of paying on time for credit cards, loans, and other debts.

- Credit Utilization (30%): How much of your available credit you’re using, with less used being better.

- Credit Mix (10%): The variety of credit types you have, like credit cards, loans, and mortgages.

- Length of Credit History (15%): How long you’ve had credit, with longer histories usually leading to higher scores.

- New Credit (10%): The number of new credit accounts you’ve opened recently, which can lower your score temporarily.

Knowing what affects your credit score helps you improve and keep a good financial status.

Tips to Improve Your Credit Score

Having a good credit score is key for getting loans, renting a place, or even getting a job. Luckily, there are many ways to improve your credit score and better your financial health. Here are some top strategies to consider.

Pay Bills on Time

Your payment history greatly affects your credit score. Paying your bills on time shows you’re a reliable borrower. This includes credit card bills, loans, and utility payments. Use automatic payments or reminders to avoid missing due dates.

Keep Credit Card Balances Low

Keeping your credit card balances low also helps your score. Experts say keep your credit card use below 30% of your limit. This shows you handle your debt well and aren’t overusing credit.

“Paying your bills on time and keeping your credit card balances low are two of the most effective ways to improve your credit score and secure a brighter financial future.”

By following these easy yet effective tips, you can actively work on boosting your credit score. This opens up more financial opportunities. Remember, building a strong credit history takes time and discipline, but it’s worth it.

In this article, we’ve looked into how to understand credit scores and improve yours. Your credit score is key when lenders decide on your financial future. So, it’s vital to know about it and act to keep your score healthy.

A good credit score means better interest rates and loan terms. It also means more financial opportunities. By paying bills on time and keeping credit card balances low, you can manage your finances better. Regularly check your credit report to stay on top of things.

Improving your credit score takes time and effort. But, the benefits are huge. By understanding your credit score, you’re on your way to financial stability and success.

FAQ

What is a credit score and why is it important?

A credit score shows how likely you are to pay back money, from 300 to 850. It’s key for getting loans, credit cards, and even renting a place. Lenders and landlords check your score to see if they should lend to you. A good score means better financial chances for you.

How are credit scores calculated?

Credit scores look at your payment history, how much credit you use, your credit mix, how long you’ve had credit, and new credit requests. Payment history is the biggest part, making up about 35% of your score. Keeping your credit card use low and having a variety of credit can help your score.

What are some strategies to improve my credit score?

Here are some tips to raise your credit score: – Pay all your bills on time: This is key for your score, so pay bills like credit cards, loans, and utilities on or before due dates. – Keep credit card balances low: Try to keep your credit card use under 30% of your limit. This helps your credit use ratio, which is about 30% of your score. – Diversify your credit mix: Having different credit types, like credit cards, loans, and mortgages, shows you can handle various credits well. – Check your credit report: Look at your credit report often to fix any mistakes. This can help improve your score.